0001655888false424B2iso4217:USDxbrli:pureiso4217:USDxbrli:sharesxbrli:shares00016558882024-11-132024-11-130001655888ck0001655888:UnsecuredNotesRiskMember2024-11-132024-11-130001655888ck0001655888:StructurallySubordinatedToIndebtednessAndOtherLiabilitiesRiskMember2024-11-132024-11-130001655888ck0001655888:IndebtednessRiskMember2024-11-132024-11-130001655888ck0001655888:CreditRatingRiskMember2024-11-132024-11-130001655888ck0001655888:IndentureOffersLimitedProtectionRiskMember2024-11-132024-11-130001655888ck0001655888:OptionalRedemptionProvisionRiskMember2024-11-132024-11-130001655888ck0001655888:ChangeOfControlRepurchaseEventRiskMember2024-11-132024-11-130001655888ck0001655888:ActiveTradingMarketRiskMember2024-11-132024-11-130001655888ck0001655888:MergersRiskMember2024-11-132024-11-1300016558882024-06-2600016558882024-03-3100016558882024-01-012024-03-3100016558882024-04-012024-06-2600016558882023-03-3100016558882023-01-012023-03-3100016558882023-06-3000016558882023-04-012023-06-3000016558882023-09-3000016558882023-07-012023-09-3000016558882023-12-3100016558882023-10-012023-12-3100016558882022-03-3100016558882022-01-012022-03-3100016558882022-06-3000016558882022-04-012022-06-3000016558882022-09-3000016558882022-07-012022-09-3000016558882022-12-3100016558882022-10-012022-12-3100016558882021-03-3100016558882021-01-012021-03-3100016558882021-06-3000016558882021-04-012021-06-3000016558882021-09-3000016558882021-07-012021-09-3000016558882021-12-3100016558882021-10-012021-12-310001655888us-gaap:CommonStockMember2024-11-132024-11-130001655888us-gaap:PreferredStockMember2024-11-132024-11-130001655888ck0001655888:SubscriptionRightsMember2024-11-132024-11-130001655888us-gaap:WarrantMember2024-11-132024-11-130001655888ck0001655888:UnitMember2024-11-132024-11-13

Filed Pursuant to Rule 424(b)(2)

Registration No. 333-280593

PROSPECTUS SUPPLEMENT

(To Prospectus dated June 28, 2024)

$400,000,000

Blue Owl Capital Corporation

5.950% Notes Due 2029

We are offering $400,000,000 in aggregate principal amount of 5.950% notes due 2029, which we refer to as the Notes. The Notes will mature on March 15, 2029. We will pay interest on the Notes on March 15 and September 15 of each year. The Notes offered hereby are a further issuance of the 5.950% notes due 2029 that were issued on January 22, 2024 in the aggregate amount of $600.0 million (the “Existing Notes”). The Notes offered hereby will be treated as a single series with the Existing Notes under the indenture and will have the same terms as the Existing Notes (except the issue date, the offering price and the initial interest payment date). The Notes offered hereby will have the same CUSIP number and will be fungible and rank equally with the Existing Notes. Upon the issuance of the Notes offered hereby, the outstanding aggregate principal amount of our 5.950% notes due 2029 will be $1,000,000,000. Unless the context otherwise requires, references herein to the “Notes” include the Notes offered hereby and the Existing Notes.

We may redeem the Notes in whole or in part at any time or from time to time at the redemption price discussed under the caption “Description of the Notes — Optional Redemption” in this prospectus supplement. In addition, holders of the Notes can require us to repurchase the Notes at 100% of their principal amount upon the occurrence of a Change of Control Repurchase Event (as defined herein). The Notes will be issued in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof.

The Notes are our direct unsecured obligation and rank pari passu, or equal in right of payment, with all outstanding and future unsecured unsubordinated indebtedness issued by us. As of September 30, 2024, we had approximately $7.8 billion of debt outstanding of which $4.4 billion was unsecured and unsubordinated indebtedness and $3.5 billion was indebtedness secured by our assets or assets of our subsidiaries, and, therefore, will be effectively and/or structurally senior to the Notes.

We are a specialty finance company focused on lending to U.S. middle market companies. We define “middle market companies” to generally mean companies with earnings before interest expense, income tax expense, depreciation and amortization (“EBITDA”) between $10 million and $250 million annually, and/or annual revenue of $50 million to $2.5 billion at the time of investment, although we may on occasion invest in smaller or larger companies if an opportunity presents itself.

We invest in senior secured or unsecured loans, subordinated loans or mezzanine loans and, to a lesser extent, equity and equity- related securities including warrants, preferred stock and similar forms of senior equity, which may or may not be convertible into a portfolio company’s common equity. The debt in which we invest typically is not rated by any rating agency, but if these instruments were rated, they would likely receive a rating of below investment grade (that is, below BBB- or Baa3), which is often referred to as “high yield” or “junk.” Our investment objective is to generate current income and, to a lesser extent, capital appreciation by targeting investment opportunities with favorable risk-adjusted returns.

We are an externally managed, closed-end management investment company that has elected to be regulated as a business development company (“BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”). We have elected to be treated, and intend to qualify annually, as a regulated investment company (“RIC”) under the Internal Revenue Code of 1986, as amended (the “Code”), for U.S. federal income tax purposes. As a BDC and a RIC, we are required to comply with certain statutory and regulatory requirements.

Investing in the Notes involves risks, including the risk of leverage, that are described in “Risk Factors” beginning on page S-22 of this prospectus supplement and page 29 of the accompanying prospectus. This prospectus supplement and the accompanying prospectus contain important information you should know before investing in the Notes. Please read this prospectus supplement and the accompanying prospectus and the documents incorporated by reference herein and therein before investing and keep it for future reference. We also file periodic and current reports, proxy statements and other information about us with the U.S. Securities and Exchange Commission (the “SEC”). This information is available free of charge by contacting us at 399 Park Avenue, New York, NY 10022, calling us at (212) 419-3000 or visiting our corporate website located at www.blueowlcapitalcorporation.com. Information on our website is not incorporated into or a part of this prospectus supplement or the accompanying prospectus. The SEC also maintains a website at http://www.sec.gov that contains this information.

THE NOTES ARE NOT DEPOSITS OR OTHER OBLIGATIONS OF A BANK AND ARE NOT INSURED BY THE FEDERAL DEPOSIT INSURANCE CORPORATION OR ANY OTHER GOVERNMENT AGENCY.

Neither the SEC nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

| | | | | | | | | | | |

| Per Note | | Total |

Public offering price(1) | 100.043 | % | | $ | 400,172,000 | |

Sales load (underwriting discounts and commissions) paid by us | 0.900 | % | | $ | 3,600,000 | |

Proceeds to us, before expenses(2) | 99.143 | % | | $ | 396,572,000 | |

______________

(1)The public offering price set forth above does not include accrued and unpaid interest of $4,231,111.11 in the aggregate from and including September 15, 2024 up to, but not including the date of delivery set forth below, which will be paid by the purchasers of the Notes offered hereby. On March 15, 2025, we will pay this pre-issuance accrued interest to the holders of the Notes offered hereby as of the applicable record date along with the interest accrued on the Notes offered hereby from the date of delivery to such interest payment date.

(2)We estimate that we will incur offering expenses of approximately $1,500,000.

Delivery of the Notes offered hereby in book-entry form only through the Depository Trust Company on or about November 19, 2024.

Joint Book-Running Managers

| | | | | | | | | | | | | | | | | | | | | | | |

RBC Capital Markets | MUFG | SMBC Nikko | Santander | SOCIETE GENERALE |

| BofA Securities | ING | J.P. Morgan | Truist Securities |

Co-Managers

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Goldman Sachs & Co. LLC | HSBC | M&T Securities | Morgan Stanley | Regions Securities LLC | TD Securities | US Bancorp | Wells Fargo Securities |

| ICBC Standard Bank | Natixis | R. Seelaus & Co., LLC | Independence Point Securities | Roberts & Ryan | Siebert Williams Shank |

The date of this prospectus supplement is November 12, 2024

Prospectus Supplement

TABLE OF CONTENTS

Prospectus

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

Neither we nor the underwriters have authorized anyone to give you any information other than the information in this prospectus supplement, the accompanying prospectus, any free writing prospectus, or any information that we have incorporated by reference herein or therein and we and the underwriters take no responsibility for any other information that others may give you. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement and the accompanying prospectus is accurate only as of the date on their respective front covers. Our business, financial condition, results of operations and prospects may have changed since that date. We will update these documents to reflect material changes only as required by law. This prospectus supplement supersedes the accompanying prospectus to the extent it contains information different from or additional to the information in that prospectus.

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering and also adds to and updates information contained in the accompanying prospectus. The second part is the accompanying prospectus, which gives more general information and disclosure. To the extent the information contained in this prospectus supplement differs from the information contained in the accompanying prospectus, the information in this prospectus supplement shall control. This prospectus supplement and the accompanying prospectus, together with any documents incorporated by reference herein and therein, include all material information relating to the applicable offering. Please carefully read this prospectus supplement and the accompanying prospectus, together with any documents incorporated by reference herein and therein, any exhibits and the additional information described under the headings “Incorporation of Certain Information By Reference,” “Prospectus Summary” and “Risk Factors” in this prospectus supplement and the accompanying prospectus, “Available Information” in the accompanying prospectus and the documents incorporated herein and therein before you make an investment decision. This prospectus supplement includes summaries of certain provisions contained in some of the documents described in this prospectus supplement, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed, or will be incorporated by reference as exhibits to the registration statement of which this prospectus supplement is a part, and you may obtain copies of those documents as described in the section titled “Available Information” in the accompanying prospectus.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights some of the information in this prospectus supplement and the accompanying prospectus and the information incorporated by reference herein and therein. It is not complete and may not contain all of the information that you may want to consider before investing in the Notes. You should read this entire document and the other information incorporated by reference herein before investing in the Notes. Throughout this prospectus supplement we refer to Blue Owl Capital Corporation as “we,” “us,” “our” or the “Company,” and to “Blue Owl Credit Advisors LLC,” our investment adviser, as “OCA” or the “Adviser.”

Blue Owl Capital Corporation

Blue Owl Capital Corporation is a Maryland corporation formed on October 15, 2015. We were formed primarily to originate and make loans to, and make debt and equity investments in, U.S. middle market companies. We invest in senior secured or unsecured loans, subordinated loans or mezzanine loans and, to a lesser extent, equity and equity-related securities including warrants, preferred stock and similar forms of senior equity, which may or may not be convertible into a portfolio company’s common equity. Our investment objective is to generate current income, and to a lesser extent, capital appreciation by targeting investment opportunities with favorable risk-adjusted returns.

We are managed by Blue Owl Credit Advisors LLC. The Adviser is registered with the U.S. Securities and Exchange Commission (the “SEC”) as an investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), an indirect affiliate of Blue Owl Capital Inc. (“Blue Owl”) (NYSE: OWL) and part of Blue Owl’s Credit platform, which focuses on direct lending. Subject to the overall supervision of our board of directors (“the Board” or “our Board”), the Adviser manages our day-to-day operations, and provides investment advisory and management services to us. The Adviser or its affiliates may engage in certain origination activities and receive attendant arrangement, structuring or similar fees. The Adviser is responsible for managing our business and activities, including sourcing investment opportunities, conducting research, performing diligence on potential investments, structuring our investments, and monitoring our portfolio companies on an ongoing basis through a team of investment professionals.

The Adviser also serves as investment adviser to Blue Owl Capital Corporation II and Blue Owl Credit Income Corp.

Blue Owl consists of three investment platforms: (1) Credit, which focuses on direct lending, (2) GP Strategic Capital, which focuses on acquiring equity stakes in and providing debt financing to institutional alternative asset managers, and (3) Real Estate, which focuses on triple net lease real estate strategies and real estate credit. Blue Owl’s Credit platform is comprised of the Adviser, Blue Owl Technology Credit Advisors LLC, Blue Owl Technology Credit Advisors II LLC, Blue Owl Credit Private Fund Advisors LLC and Blue Owl Diversified Credit Advisors LLC (collectively, the “Blue Owl Credit Advisers”), which also are registered investment advisers.

We are a specialty finance company focused on lending to U.S. middle market companies. We define “middle market companies” to generally mean companies with EBITDA between $10 million and $250 million annually, and/or annual revenue of $50 million to $2.5 billion at the time of investment, although we may on occasion invest in smaller or larger companies if an opportunity presents itself. We generally seek to invest in companies with a loan-to-value ratio of 50% or below. Our target credit investments will typically have maturities between three and ten years and generally range in size between $20 million and $250 million. The investment size will vary with the size of our capital base. The debt in which we invest typically is not rated by any rating agency, but if these instruments were rated, they would likely receive a rating of below investment grade (that is, below BBB- or Baa3), which is often referred to as “high yield” or “junk.” As of September 30, 2024, our average debt investment size in each of our portfolio companies was approximately $55.9 million based on fair value. As of September 30, 2024, our portfolio companies, excluding the investment in OBDC SLF LLC (“OBDC SLF”), Blue Owl Credit SLF LLC (“Credit SLF”) and certain investments that fall outside of our typical borrower profile, representing 90.1% of our total debt portfolio based on fair value, had weighted average annual revenue of $875 million, weighted average annual EBITDA of $197 million, an average interest coverage of 1.7x and an average net loan-to value of 43%.

We invest in senior secured or unsecured loans, subordinated loans or mezzanine loans and, to a lesser extent, equity and equity-related securities including warrants, preferred stock and similar forms of senior equity, which may or may not be convertible into a portfolio company’s common equity. Our investment objective is to generate current income and, to a lesser extent, capital appreciation by targeting investment opportunities with favorable risk-adjusted returns.

We are an externally managed, closed-end management investment company that has elected to be regulated as a BDC under the 1940 Act. We have elected to be treated, and intend to qualify annually, as a RIC for U.S. federal income tax purposes. As a BDC and a RIC, we are required to comply with certain statutory and regulatory requirements. As a BDC, at least 70% of our assets must be assets of the type listed in Section 55(a) of the 1940 Act. See “Business — Regulation as a Business Development Company” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (“2023 Form 10-K”) and “Certain U.S. Federal Income Tax Considerations” in the accompanying prospectus. We will not invest more than 20% of our total assets in companies whose principal place of business is outside the United States. We generally intend to distribute, out of assets legally available for distribution, substantially all of our available earnings, on a quarterly basis, as determined by our Board in its sole discretion.

To achieve our investment objective, we will leverage the Adviser’s investment team’s extensive network of relationships with other sophisticated institutions to source, evaluate and, as appropriate, partner with on transactions. There are no assurances that we will achieve our investment objective.

A BDC generally may borrow money from time to time if immediately after such borrowing, the ratio of the BDC’s total assets (less total liabilities other than indebtedness represented by senior securities) to its total indebtedness represented by senior securities plus preferred stock, if any, or its “asset coverage,” is at least 200%, or 150%, if certain requirements are met. This means that, generally, a BDC may borrow up to $1 for every $1 of investor equity, or, if certain conditions are met, a BDC may borrow up to $2 for every $1 of investor equity.

As of September 30, 2024, we had in place the Amended and Restated Senior Secured Revolving Credit Agreement (the “Revolving Credit Facility”), one special purpose vehicle asset credit facility (the “SPV Asset Facility II), and seven term debt securitization transactions (the “OBDC CLOs”), also known as collateralized loan obligations, and in the future may enter into additional credit facilities or other financing arrangements.

In addition, as of September 30, 2024, we have issued unsecured notes maturing in March 2025 (the “2025 Notes”), July 2025 (the “July 2025 Notes”), January 2026 (the “2026 Notes”), July 2026 (the “July 2026 Notes”), January 2027 (the “2027 Notes”), June 2028 (the “2028 Notes”) and the Existing Notes in registered offerings and in the future may issue additional unsecured notes. We expect to use our credit facilities and other borrowings, along with proceeds from the rotation of our portfolio, to finance our investment objectives. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Debt” in our 2023 Form 10-K and in our Quarterly Report on Form 10-Q, for the quarter ended September 30, 2024 ( “Third Quarter 2024 Form 10-Q”). Investment Portfolio

As of September 30, 2024, we had investments in 219 portfolio companies with an aggregate fair value of $13.5 billion. As of September 30, 2024, based on fair value, our portfolio consisted of 75.9% first lien senior secured debt investments (of which 51.0% were considered to be unitranche debt investments (including “last out” portions of such loans)), 5.4% second lien senior secured debt investments, 2.3% unsecured investments, 2.9% preferred equity investments, 10.6% common equity investments and 2.9% joint ventures. As of September 30, 2024, 96.3% of our debt investments based on fair value were floating rate in nature and subject to interest rate floors.

As of September 30, 2024, our portfolio was invested across 31 different industries. The largest industry in our portfolio as of September 30, 2024 was internet software and services, which represented 11.2% of our portfolio based on fair value.

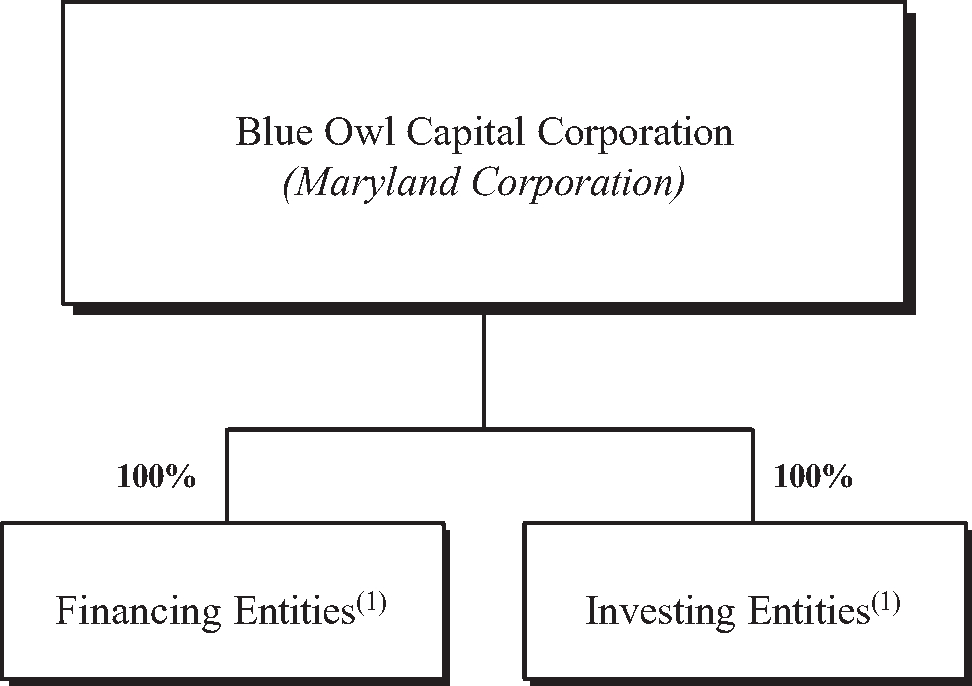

Corporate Structure

The following chart depicts our structure:

__________________

(1)From time to time we may form wholly-owned subsidiaries to facilitate the normal course of business.

The Adviser — Blue Owl Credit Advisors LLC

The Adviser serves as our investment adviser pursuant to an investment advisory agreement between us and the Adviser (the “Investment Advisory Agreement”). See “Business—The Adviser and Administrator—Blue Owl Credit Advisors LLC” in our 2023 Form 10-K. The Adviser also serves as our Administrator pursuant to an amended and restated administration agreement (the “Administration Agreement”). The Adviser is an indirect affiliate of Blue Owl and part of Blue Owl’s Credit platform, which focuses on direct lending. Blue Owl is a leading alternative asset management firm that offers differentiated capital solutions through Blue Owl’s Credit platform, its direct lending business, GP Strategic Capital, which focuses on acquiring equity stakes in and providing debt financing to institutional alternative asset managers and Real Estate, which focuses on triple net lease real estate strategies and real estate credit. The management of our investment portfolio is the responsibility of the Adviser and the Diversified Lending Investment Committee. Blue Owl’s credit platform is comprised of the Blue Owl Credit Advisers, and is led by its three co-founders, Douglas I. Ostrover, Marc S. Lipschultz and Craig W. Packer. The Adviser’s investment team (the “Investment Team”) is also led by Douglas I. Ostrover, Marc S. Lipschultz and Craig W. Packer and is supported by certain members of the Adviser’s senior executive team and Blue Owl’s Credit platform’s investment committees. Blue Owl’s Credit platform has four investment committees, each of which focuses on a specific investment strategy (Diversified Lending, Technology Lending, First Lien Lending and Opportunistic Lending). Douglas I. Ostrover, Marc S. Lipschultz, Craig W. Packer and Alexis Maged sit on each of Blue Owl’s Credit platform’s investment committees. In addition to Messrs. Ostrover, Lipschultz, Packer and Maged, the Diversified Lending Investment Committee is comprised of Patrick Linnemann, Meenal Mehta and Logan Nicholson. We consider the individuals on the Diversified Lending Investment Committee to be our portfolio managers. The Investment Team, under the Diversified Lending Investment Committee's supervision, sources investment opportunities, conducts research, performs due diligence on potential investments, structures our investments and will monitor our portfolio companies on an ongoing basis.

As of September 30 2024, the Adviser and its affiliates had $128.44 billion of assets under management across Blue Owl’s Credit platform. The Blue Owl Credit Advisers focus on direct lending to middle market companies primarily in the United States across the following four investment strategies which are offered through BDCs, private funds and separately managed accounts:

| | | | | | | | |

| Strategy | | Funds |

Diversified Lending. The diversified lending strategy seeks to generate current income and, to a lesser extent, capital appreciation by targeting investment opportunities with favorable risk-adjusted returns across credit cycles with an emphasis on preserving capital primarily through originating and making loans to, and making debt and equity investments in, U.S. middle market companies. The diversified lending strategy provides a wide range of financing solutions with strong focus on the top of the capital structure and operate this strategy through diversification by borrower, sector, sponsor, and position size. | | The diversified lending strategy is primarily offered through four BDCs: the Company, Blue Owl Capital Corporation II (“OBDC II”), Blue Owl Capital Corporation III (“OBDE”), and Blue Owl Credit Income Corp. (“OCIC”). |

| | |

Technology Lending. The technology lending strategy seeks to maximize total return by generating current income from debt investments and other income producing securities, and capital appreciation from equity and equity- linked investments primarily through originating and making loans to, and making debt and equity investments in, technology related companies based primarily in the United States. The technology lending strategy originates and invests in senior secured or unsecured loans, subordinated loans or mezzanine loans, and equity and equity-related securities including common equity, warrants, preferred stock and similar forms of senior equity, which may be convertible into a portfolio company’s common equity. The technology lending strategy invests in a broad range of established and high growth technology companies that are capitalizing on the large and growing demand for technology products and services. This strategy focuses on companies that operate in technology-related industries or sectors which include, but are not limited to, information technology, application or infrastructure software, financial services, data and analytics, security, cloud computing, communications, life sciences, healthcare, media, consumer electronics, semi-conductor, internet commerce and advertising, environmental, aerospace and defense industries and sectors. | | The technology lending strategy is primarily managed through three BDCs: Blue Owl Technology Finance Corp. (“OTF”), Blue Owl Technology Finance Corp. II (“OTF II”) and Blue Owl Technology Income Corp. (“OTIC”, and together with the Company, OBDC II, OBDE, OCIC, OTF and OTF II, “the Blue Owl BDCs”). |

| | |

First Lien Lending. The first lien lending strategy seeks to realize current income with an emphasis on preservation of capital primarily through originating primary transactions in and, to a lesser extent, secondary transactions of first lien senior secured loans in or related to middle market businesses based primarily in the United States. | | The first lien lending strategy is managed through private funds and separately managed accounts. |

| | | | | | | | |

| Strategy | | Funds |

| | |

Opportunistic Lending. The opportunistic lending strategy seeks to generate attractive risk-adjusted returns by taking advantage of credit opportunities in U.S. middle-market companies with liquidity needs and market leaders seeking to improve their balance sheets. The opportunistic lending strategy focuses on high-quality companies that could be experiencing disruption, dislocation, distress or transformational change. The opportunistic lending strategy aims to be the partner of choice for companies by being well equipped to provide a variety of financing solutions to meet a broad range of situations, including the following: (i) rescue financing, (ii) new issuance and recapitalizations, (iii) wedge capital, (iv) debtor-in-possession loans, (v) financing for additional liquidity and covenant relief and (vi) broken syndications. | | The opportunistic lending strategy is managed through private funds and separately managed accounts. |

We refer to the Blue Owl BDCs and the private funds and separately managed accounts managed by the Blue Owl Credit Advisers as the “Blue Owl Credit Clients.” In addition to the Blue Owl Credit Clients, Blue Owl’s Credit platform includes (i) an alternative credit strategy, which targets credit-oriented investments in markets underserved by traditional lenders or the broader capital markets, with deep expertise investing across specialty finance, private corporate credit and equipment leasing; (ii) an investment grade private credit strategy, which focuses on generating capital-efficient investment income through asset-backed finance, private corporate credit, and structured products; and (iii) a liquid credit strategy, which focuses on the management of CLOs. As of September 30, 2024, the alternative credit strategy, the investment grade private credit strategy and the liquid credit strategy had $10.61 billion, $17.25 billion and $8.04 billion of assets under management, respectively. Blue Owl’s Credit platform also employs various other investment strategies to pursue long-term capital appreciation and risk adjusted returns including (i) direct investments in strategic equity assets, with a focus on single-asset GP-led continuation funds, and (ii) mid-to-late-stage biopharmaceutical and healthcare companies. As of September 30, 2024, these strategies had $1.56 billion of assets under management.

In addition, the Adviser and its affiliates may provide management or investment advisory services to entities that have overlapping objectives with us. The Adviser and its affiliates may face conflicts in the allocation of investment opportunities to us and others. In order to address these conflicts, the Blue Owl Credit Advisers have put in place an investment allocation policy that addresses the allocation of investment opportunities as well as co-investment restrictions under the 1940 Act.

Market Trends

We believe the middle-market lending environment provides opportunities for us to meet our goal of making investments that generate attractive risk-adjusted returns.

Limited Availability of Capital for Middle-Market Companies. The middle market is a large addressable market. According to GE Capital’s National Center for the Middle Market Mid-Year 2024 Middle Market Indicator, there are approximately 200,000 U.S. middle market companies, which have approximately 48 million aggregate employees. Moreover, the U.S. middle market accounts for one-third of private sector gross domestic product (“GDP”). GE defines U.S. middle market companies as those between $10 million and $1 billion in annual revenue, which we believe has significant overlap with our definition of U.S. middle market companies. We believe U.S. middle market companies will continue to require access to debt capital to refinance existing debt, support growth and finance acquisitions. We believe that regulatory and structural factors, industry consolidation and general risk aversion, limit the amount of traditional financing available to U.S. middle-market companies. We believe that many commercial and investment banks have, in recent years, de-emphasized their service and product offerings to middle-market businesses in favor of lending to large corporate clients and managing capital markets transactions. In addition, these lenders may be constrained in their ability to underwrite and hold bank loans and high yield securities for middle-market issuers as they seek to meet existing and future regulatory capital requirements. We also believe that there is a lack of market participants that are willing to hold meaningful amounts of certain middle-market

loans. As a result, we believe our ability to minimize syndication risk for a company seeking financing by being able to hold its loans without having to syndicate them, coupled with reduced capacity of traditional lenders to serve the middle-market, present an attractive opportunity to invest in middle-market companies.

Capital Markets Have Been Unable to Fill the Void in U.S. Middle Market Finance Left by Banks. Access to underwritten bond and syndicated loan markets is challenging for middle market companies due to loan issue size and liquidity. For example, high yield bonds are generally purchased by institutional investors, such as mutual funds and exchange traded funds (“ETFs”) who, among other things, are focused on the liquidity characteristics of the bond being issued in order to fund investor redemptions and/or comply with regulatory requirements. Accordingly, the existence of an active secondary market for bonds is an important consideration in these entities’ initial investment decision. Syndicated loans arranged through a bank are done either on a “best efforts” basis or are underwritten with terms plus provisions that permit the underwriters to change certain terms, including pricing, structure, yield and tenor, otherwise known as “flex”, to successfully syndicate the loan, in the event the terms initially marketed are insufficiently attractive to investors. Furthermore, banks are generally reluctant to underwrite middle market loans because the arrangement fees they may earn on the placement of the debt generally are not sufficient to meet the banks’ return hurdles. Loans provided by companies such as ours provide certainty to issuers in that we have a more stable capital base and have the ability to invest in illiquid assets, and we can commit to a given amount of debt on specific terms, at stated coupons and with agreed upon fees. As we are the ultimate holder of the loans, we do not require market “flex” or other arrangements that banks may require when acting on an agency basis. In addition, our Adviser has teams focused on both liquid credit and private credit and these teams are able to collaborate with respect to syndicated loans.

Secular Trends Supporting Growth for Private Credit. We believe that periods of market volatility, such as the current period of market volatility caused, in part, by uncertainty regarding inflation and interest rates, and current geopolitical conditions, have accentuated the advantages of private credit. The availability of capital in the liquid credit market is highly sensitive to market conditions whereas we believe private lending has proven to be a stable and reliable source of capital through periods of volatility. We believe the opportunity set for private credit will continue to expand even as the public markets remain open. Financial sponsors and companies today are familiar with direct lending and have seen firsthand the strong value proposition that a private solution can offer. Scale, certainty of execution and flexibility all provide borrowers with a compelling alternative to the syndicated and high yield markets. Based on our experience, there is an emerging trend where higher quality credits that have traditionally been issuers in the syndicated and high yield markets are increasingly seeking private solutions independent of credit market conditions. In our view, this is supported by financial sponsors wanting to work with collaborative financing partners that have scale and breadth of capabilities. We believe the large amount of uninvested capital held by funds of private equity firms broadly, estimated by Preqin Ltd., an alternative assets industry data and research company, to be $2.7 trillion as of December 31, 2023, will continue to drive deal activity. We expect that private equity sponsors will continue to pursue acquisitions and leverage their equity investments with secured loans provided by companies such as us.

Attractive Investment Dynamics. An imbalance between the supply of, and demand for, middle market debt capital creates attractive pricing dynamics. We believe the directly negotiated nature of middle market financings also generally provides more favorable terms to the lender, including stronger covenant and reporting packages, better call protection, and lender-protective change of control provisions. Additionally, we believe BDC managers’ expertise in credit selection and ability to manage through credit cycles has generally resulted in BDCs experiencing lower loss rates than U.S. commercial banks through credit cycles. Further, we believe that historical middle market default rates have been lower, and recovery rates have been higher, as compared to the larger market capitalization, broadly distributed market, leading to lower cumulative losses. Lastly, we believe that in the current environment, lenders with available capital may be able to take advantage of attractive investment opportunities as the economy reopens and may be able to achieve improved economic spreads and documentation terms.

Conservative Capital Structures. Following the global credit crisis, which we define broadly as occurring between mid-2007 and mid-2009, lenders have generally required borrowers to maintain more equity as a percentage of their total capitalization, specifically to protect lenders during economic downturns. With more conservative capital structures, U.S. middle market companies have exhibited higher levels of cash flows available to service their debt. In addition, U.S. middle market companies often are characterized by simpler capital structures

than larger borrowers, which facilitates a streamlined underwriting process and, when necessary, restructuring process.

Attractive Opportunities in Investments in Loans. We invest in senior secured or unsecured loans, subordinated loans or mezzanine loans and, to a lesser extent, equity and equity-related securities. We believe that opportunities in senior secured loans are significant because of the floating rate structure of most senior secured debt issuances and because of the strong defensive characteristics of these types of investments. We believe that debt issues with floating interest rates offer a superior return profile as compared with fixed-rate investments, since floating rate structures are generally less susceptible to declines in value experienced by fixed-rate securities in a rising interest rate environment. Senior secured debt also provides strong defensive characteristics. Senior secured debt has priority in payment among an issuer’s security holders whereby holders are due to receive payment before junior creditors and equity holders. Further, these investments are secured by the issuer’s assets, which may provide protection in the event of a default.

Potential Competitive Advantages

We believe that the Adviser’s disciplined approach to origination, fundamental credit analysis, portfolio construction and risk management should allow us to achieve attractive risk-adjusted returns while preserving our capital. We believe that we represent an attractive investment opportunity for the following reasons:

Experienced Team with Expertise Across all Levels of the Corporate Capital Structure. The members of the Diversified Lending Investment Committee have an average of over 25 years of experience in private lending and investing at all levels of a company’s capital structure, particularly in high yield securities, leveraged loans, high yield credit derivatives and distressed securities, as well as experience in operations, corporate finance, mergers and acquisitions, and workout restructuring. The members of the Diversified Lending Investment Committee have diverse backgrounds with investing experience through multiple business and credit cycles. Moreover, certain members of the Diversified Lending Investment Committee and other executives and employees of the Adviser and its affiliates have operating and/or investing experience on behalf of business development companies. We believe this experience provides the Adviser with an in-depth understanding of the strategic, financial and operational challenges and opportunities of middle-market companies and will afford it numerous tools to manage risk while preserving the opportunity for attractive risk-adjusted returns on our investments and offering a diverse product set to help meet borrowers’ needs.

Distinctive Origination Platform. To date, a substantial majority of our investments have been sourced directly. We believe that our origination platform provides us the ability to originate investments without the assistance of investment banks or other traditional Wall Street intermediaries

The Investment Team includes more than 130 investment professionals and is responsible for originating, underwriting, executing and managing the assets of our direct lending transactions and for sourcing and executing opportunities directly. The Investment Team has significant experience as transaction originators and building and maintaining strong relationships with private equity sponsors and companies. In addition, we believe that as a result of the formation of Blue Owl, the investment team has enhanced sourcing capabilities because of their ability to utilize Blue Owl’s resources and its relationships with the financial sponsor community and service providers, which we believe may broaden our deal funnel and result in an increased pipeline of deal opportunities. The Investment Team also maintains direct contact with banks, corporate advisory firms, industry consultants, attorneys, investment banks, “club” investors and other potential sources of lending opportunities. We believe the Adviser’s ability to source through multiple channels allows us to generate investment opportunities that have more attractive risk-adjusted return characteristics than by relying solely on origination flow from investment banks or other intermediaries and to be more selective investors.

Since its inception in April 2016 through September 30, 2024, the Adviser and its affiliates have reviewed approximately 10,000 opportunities and sourced potential investment opportunities from more than 760 private equity sponsors and venture capital firms. We believe that the Adviser receives “early looks” and “last looks” based on its and Blue Owl’s relationships, allowing it to be highly selective in the transactions it pursues.

Potential Long-Term Investment Horizon. We believe our potential long-term investment horizon gives us flexibility, allowing us to maximize returns on our investments. We invest using a long-term focus, which we believe provides us with the opportunity to increase total returns on invested capital, as compared to other private company investment vehicles or investment vehicles with daily liquidity requirements (e.g., open-ended mutual funds and ETFs). Defensive, Income-Orientated Investment Philosophy. The Adviser employs a defensive investment approach focused on long-term credit performance and principal protection. This investment approach involves a multi-stage selection process for each investment opportunity as well as ongoing monitoring of each investment made, with particular emphasis on early detection of credit deterioration. This strategy is designed to minimize potential losses and achieve attractive risk adjusted returns.

Active Portfolio Monitoring. The Adviser closely monitors the investments in our portfolio and takes a proactive approach to identifying and addressing sector- or company-specific risks. The Adviser receives and reviews detailed financial information from portfolio companies no less than quarterly and seeks to maintain regular dialogue with portfolio company management teams regarding current and forecasted performance. Although we may invest in “covenant-lite” loans (as defined below), which generally do not have a complete set of financial maintenance covenants, we anticipate that many of our investments will have financial covenants that we believe will provide an early warning of potential problems facing our borrowers, allowing lenders, including us, to identify and carefully manage risk. Further, we anticipate that many of our equity investments will provide us the opportunity to nominate a member or observer to the board of directors of the portfolio company or otherwise include provisions protecting our rights as a minority-interest holder, which we believe will allow us to closely monitor the performance of these portfolio companies. In addition, the Adviser has built out its portfolio management team to include workout experts who closely monitor our portfolio companies and who, on at least a quarterly basis, assess each portfolio company’s operational and liquidity exposure and outlook to understand and mitigate risks; and, on at least a monthly basis, evaluate existing and newly identified situations where operating results are deviating from expectations. As part of its monitoring process, the Adviser focuses on projected liquidity needs and where warranted, re-underwriting credits and evaluating downside and liquidation scenarios.

Structure of Investments

Our investment objective is to generate current income and, to a lesser extent, capital appreciation by targeting investment opportunities with favorable risk-adjusted returns.

We expect that generally our portfolio composition will be majority debt or income producing securities, which may include “covenant-lite” loans, with a lesser allocation to equity or equity-linked opportunities, which we may hold directly or through special purpose vehicles. In addition, we may invest a portion of our portfolio in opportunistic investments and broadly syndicated loans, which will not be our primary focus, but will be intended to enhance returns to our shareholders and from time to time, we may evaluate and enter into strategic portfolio transactions which may result in additional portfolio companies which we are considered to control. These investments may include high-yield bonds and broadly-syndicated loans, including publicly traded debt instruments, which are typically originated and structured by banks on behalf of large corporate borrowers with employee counts, revenues, EBITDAs and enterprise values larger than those of middle market companies described above, and equity investments in portfolio companies that make senior secured loans or invest in broadly syndicated loans or structured products, such as life settlements and royalty interests. In addition, we generally do not intend to invest more than 20% of our total assets in companies whose principal place of business is outside the United States, although we do not generally intend to invest in companies whose principal place of business is in an emerging market. Our portfolio composition may fluctuate from time to time based on market conditions and interest rates.

Covenants are contractual restrictions that lenders place on companies to limit the corporate actions a company may pursue. Generally, the loans in which we expect to invest will have financial maintenance covenants, which are used to proactively address materially adverse changes in a portfolio company’s financial performance. However, to a lesser extent, we may invest in “covenant-lite” loans. We use the term “covenant-lite” to refer generally to loans that do not have a complete set of financial maintenance covenants. Generally, “covenant-lite” loans provide borrower companies more freedom to negatively impact lenders because their covenants are incurrence-based, which means they are only tested and can only be breached following an affirmative action of the borrower, rather than by a deterioration in the borrower’s financial condition. Accordingly, to the extent we invest in “covenant-lite”

loans, we may have fewer rights against a borrower and may have a greater risk of loss on such investments as compared to investments in or exposure to loans with financial maintenance covenants.

Debt Investments. The terms of our debt investments are tailored to the facts and circumstances of each transaction. The Adviser negotiates the structure of each investment to protect our rights and manage our risk. We generally invest in the following types of debt:

•First-lien debt. First-lien debt typically is senior on a lien basis to other liabilities in the issuer’s capital structure and has the benefit of a first-priority security interest in assets of the issuer. The security interest ranks above the security interest of any second-lien lenders in those assets. Our first-lien debt may include stand-alone first-lien loans, “unitranche” loans (including “last out” portions of such loans), and secured corporate bonds with similar features to these categories of first-lien loans. As of September 30, 2024, 51% of our first lien debt was comprised of unitranche loans.

•Stand-alone first lien loans. Stand-alone first-lien loans are traditional first-lien loans. All lenders in the facility have equal rights to the collateral that is subject to the first-priority security interest.

•Unitranche loans. Unitranche loans (including the “last out” portions of such loans) combine features of first-lien, second-lien and mezzanine debt, generally in a first-lien position. In many cases, we may provide the issuer most, if not all, of the capital structure above their equity. The primary advantages to the issuer are the ability to negotiate the entire debt financing with one lender and the elimination of intercreditor issues. “Last out” first-lien loans have a secondary priority behind super-senior “first out” first-lien loans in the collateral securing the loans in certain circumstances. The arrangements for a “last out” first-lien loan are typically set forth in an “agreement among lenders,” which provides lenders with “first out” and “last out” payment streams based on a single lien on the collateral. Since the “first out” lenders generally have priority over the “last out” lenders for receiving payment under certain specified events of default, or upon the occurrence of other triggering events under intercreditor agreements or agreements among lenders, the “last out” lenders bear a greater risk and, in exchange, receive a higher effective interest rate, through arrangements among the lenders, than the “first out” lenders or lenders in stand-alone first-lien loans. Agreements among lenders also typically provide greater voting rights to the “last out” lenders than the intercreditor agreements to which second-lien lenders often are subject. Among the types of first-lien debt in which we may invest, “last out” first-lien loans generally have higher effective interest rates than other types of first-lien loans, since “last out” first-lien loans rank below standalone first-lien loans.

•Second-lien debt. Our second-lien debt may include secured loans, and, to a lesser extent, secured corporate bonds, with a secondary priority behind first-lien debt. Second-lien debt typically is senior on a lien basis to unsecured liabilities in the issuer’s capital structure and has the benefit of a security interest over assets of the issuer, though ranking junior to first-lien debt secured by those assets. First- lien lenders and second-lien lenders typically have separate liens on the collateral, and an intercreditor agreement provides the first-lien lenders with priority over the second-lien lenders’ liens on the collateral.

•Mezzanine debt. Structurally, mezzanine debt usually ranks subordinate in priority of payment to first- lien and second-lien debt, is often unsecured, and may not have the benefit of financial covenants common in first-lien and second-lien debt. However, mezzanine debt ranks senior to common and preferred equity in an issuer’s capital structure. Mezzanine debt investments generally offer lenders fixed returns in the form of interest payments, which could be paid-in-kind, and may provide lenders an opportunity to participate in the capital appreciation, if any, of an issuer through an equity interest. This equity interest typically takes the form of an equity co-investment or warrants. Due to its higher risk profile and often less restrictive covenants compared to senior secured loans, mezzanine debt generally bears a higher stated interest rate than first-lien and second-lien debt.

•Broadly syndicated loans. Broadly syndicated loans (whose features are similar to those described under “First-lien debt” and “Second-lien debt” above) are typically originated and structured by banks on behalf of large corporate borrowers with employee counts, revenues, EBITDAs, and enterprise values larger than

the middle-market characteristics described above. The proceeds of broadly syndicated loans are often used for leveraged buyout transactions, mergers and acquisitions,

recapitalizations, refinancings, and financing capital expenditures. Broadly syndicated loans are typically distributed by the arranging bank to a diverse group of investors primarily consisting of: collateralized loan obligations; senior secured loan and high yield bond mutual funds; closed-end funds, hedge funds, banks, and insurance companies; and finance companies. A borrower must comply with various covenants contained in a loan agreement or note purchase agreement between the borrower and the holders of the broadly syndicated loan. The broadly syndicated loans in which we invest may include loans that are considered “covenant-lite” loans, because of their lack of a full set of financial maintenance covenants.

Our debt investments are typically structured with the maximum seniority and collateral that we can reasonably obtain while seeking to achieve our total return target. The Adviser seeks to limit the downside potential of our investments by:

•requiring a total return on our investments (including both interest and potential equity appreciation) that compensates us for credit risk;

•negotiating covenants in connection with our investments consistent with preservation of our capital. Such restrictions may include affirmative covenants (including reporting requirements), negative covenants (including financial maintenance covenants), lien protection, limitations on debt incurrence, restrictions on asset sales, downside and liquidation cases, restrictions on dividends and other payments, cash flow sweeps, collateral protection, required debt amortization, change of control provisions and board rights, including either observation rights or rights to a seat on the board under some circumstances; and

•including debt amortization requirements, where appropriate, to require the timely repayment of principal of the loan, as well as appropriate maturity dates.

Within our portfolio, the Adviser aims to maintain the appropriate proportion among the various types of first-lien loans, as well as second-lien debt and mezzanine debt, to allow us to achieve our target returns while maintaining our targeted amount of credit risk.

Equity Investments. Our investment in a portfolio company could be or may include an equity interest, such as common stock or preferred stock, or equity linked interest, such as a warrant or profit participation right. We may make direct and indirect equity investments with or without a concurrent investment in a more senior part of the capital structure of the issuer. Our equity investments are typically not control-oriented investments and we may structure such equity investments to include provisions protecting our rights as a minority-interest holder.

Specialty Financing Portfolio Companies. We may make equity investments in portfolio companies that make senior secured loans or invest in broadly syndicated loans or structured products, such as life settlements and royalty interests. Our specialty financing companies include the following:

•Wingspire Capital Holdings LLC (“Wingspire”), an independent diversified direct lender focused on providing asset-based commercial finance loans and related senior secured loans to U.S.-based middle market borrowers. Wingspire offers a wide variety of asset-based financing solutions to businesses in an array of industries, including revolving credit facilities, machinery and equipment term loans, real estate term loans, first-in/last-out tranches, cash flow term loans, and opportunistic/bridge financings.

•Amergin, which consists of AAM Series 1.1 Rail and Domestic Intermodal Feeder, LLC and AAM Series 2.1 Aviation Feeder, LLC (collectively, “Amergin AssetCo”) and Amergin Asset Management LLC, which has entered into a Servicing Agreement with Amergin AssetCo. Amergin was created to invest in a leasing platform focused on railcar, aviation and other long-lived transportation assets. Amergin acquires existing on-lease portfolios of new and end-of-life railcars and related equipment and selectively purchases off-lease assets and is building a commercial aircraft portfolio through aircraft financing and engine acquisition on a sale and lease back basis.

•Fifth Season Investments LLC (“Fifth Season”), a portfolio company created to invest in life insurance based assets, including secondary and tertiary life settlement and other life insurance exposures using detailed analytics, internal life expectancy review and sophisticated portfolio management techniques.

•LSI Financing 1 DAC (“LSI Financing”), a portfolio company formed to acquire contractual rights to revenue pursuant to earnout agreements in the life sciences space.

OBDC SLF LLC (“OBDC SLF”). We may make equity investments in OBDC SLF, a Delaware limited liability company, which is a joint venture between us and Nationwide Life Insurance Company. OBDC SLF’s principal purpose is to make investments, primarily in senior secured loans that are made to middle-market companies or in broadly syndicated loans.

Blue Owl Credit SLF LLC (“Credit SLF”). We may make equity investments in Credit SLF, a Delaware limited liability company, which is a joint venture between us, OBDC II, OBDE, OCIC, OTF, OTF II, OTIC, and State Teachers Retirement System of Ohio. Credit SLF’s principal purpose is to make investments in senior secured loans to middle-market companies, broadly syndicated loans and senior and subordinated notes issued by collateralized loan obligations.

Conflicts of Interests

We have entered into both the Investment Advisory Agreement and the Administration Agreement with the Adviser. See “Business—The Adviser and Administrator—Blue Owl Credit Advisors LLC” in our 2023 Form 10-K. Pursuant to the Investment Advisory Agreement, we pay the Adviser a base management fee and an incentive fee. See “Business — Investment Advisory Agreement” in our 2023 Form 10-K for a description of how the fees payable to the Adviser will be determined. Pursuant to the Administration Agreement, we reimburse the Adviser for expenses necessary to perform services related to our administration and operations. See “Business — Administration Agreement” in our 2023 Form 10-K for a description of services for which we reimburse to the Adviser. In addition, the Adviser or its affiliates may engage in certain origination activities and receive attendant arrangement, structuring or similar fees. In addition, we are seeking shareholder approval of a Fourth Amended and Restated Investment Advisory Agreement (the “New Investment Advisory Agreement”). The New Investment Advisory Agreement would adjust the calculation of the incentive fee based on income to exclude any amortization or accretion of any purchase premium or discount to interest income resulting solely from the purchase accounting for any purchase premium or discount paid for the acquisition of assets in a merger, including the Mergers (as defined below), and the calculation of the incentive fee based on capital gains will be adjusted to exclude realized capital gains, realized capital losses or unrealized capital appreciation or depreciation resulting solely from the purchase accounting for any purchase premium or discount paid for the acquisition of assets in a merger, including the Mergers. See our joint proxy statement/prospectus filed with the SEC on October 21, 2024.

Our executive officers, certain of our directors and certain other finance professionals of Blue Owl also serve as executives of the Adviser and the Blue Owl Credit Advisers, and certain of our officers and directors and professionals of Blue Owl and the Blue Owl Credit Advisers are officers of Blue Owl Securities LLC and Blue Owl. In addition, our executive officers and directors and the members of the Adviser and members of its investment committee serve or may serve as officers, directors or principals of entities that operate in the same, or a related, line of business as we do (including the Blue Owl Credit Advisers), including serving on their respective investment committees and/or on the investment committees of investments funds, accounts or other investment vehicles managed by our affiliates which may have investment objectives similar to our investment objective. At times we may compete with the Blue Owl Credit Clients for capital and investment opportunities. As a result, we may not be given the opportunity to participate in certain investments made by the Blue Owl Credit Clients. This can create a potential conflict when allocating investment opportunities among us and such other Blue Owl Credit Clients. An investment opportunity that is suitable for multiple clients of the Adviser and its affiliates may not be capable of being shared among some or all of such clients and affiliates due to the limited scale of the opportunity or other factors, including regulatory restrictions imposed by the 1940 Act. However, in order for the Adviser and its

affiliates to fulfill their fiduciary duties to each of their clients, the Blue Owl Credit Advisers have put in place an investment allocation policy that seeks to ensure the fair and equitable allocation of investment opportunities over time and addresses the co-investment restrictions set forth under the 1940 Act.

Allocation of Investment Opportunities

The Blue Owl Credit Advisers intend to allocate investment opportunities in a manner that is fair and equitable over time and is consistent with its investment allocation policy, so that no client of the Adviser or its affiliates is disadvantaged in relation to any other client of the Adviser or its affiliates, taking into account such factors as the relative amounts of capital available for new investments, cash on hand, existing commitments and reserves, the investment programs and portfolio positions of the participating investment accounts, the clients for which participation is appropriate, targeted leverage level, targeted asset mix and any other factors deemed appropriate. The Blue Owl Credit Advisers intend to allocate common expenses among us and other clients of the Adviser and its affiliates in a manner that is fair and equitable over time or in such other manner as may be required by applicable law or the Investment Advisory Agreement. Fees and expenses generated in connection with potential portfolio investments that are not consummated will be allocated in a manner that is fair and equitable over time and in accordance with policies adopted by the Blue Owl Credit Advisers and the Investment Advisory Agreement.

The Blue Owl Credit Advisers have put in place an investment allocation policy that seeks to ensure the equitable allocation of investment opportunities over time and addresses the co-investment restrictions set forth under the 1940 Act. When we engage in co-investments as permitted by the exemptive relief described below, we will do so in a manner consistent with the Blue Owl Credit Advisers’ investment allocation policy. In situations where co-investment with other entities managed by the Adviser or its affiliates is not permitted or appropriate, such as when there is an opportunity to invest in different securities of the same issuer, a committee comprised of certain executive officers of the Blue Owl Credit Advisers (including executive officers of the Adviser) along with other officers and employees, will need to decide whether we or such other entity or entities will proceed with the investment. The allocation committee will make these determinations based on the Blue Owl Credit Advisers’ investment allocation policy, which generally requires that such opportunities be offered to eligible accounts in a manner that will be fair and equitable over time.

The Blue Owl Credit Advisers’ investment allocation policy is designed to manage the potential conflicts of interest between the Adviser’s fiduciary obligations to us and its or its affiliates’ similar fiduciary obligations to other clients, including the Blue Owl Credit Clients; however, there can be no assurance that the Blue Owl Credit Advisers’ efforts to allocate any particular investment opportunity fairly among all clients for whom such opportunity is appropriate will result in an allocation of all or part of such opportunity to us. Not all conflicts of interest can be expected to be resolved in our favor.

The allocation of investment opportunities among us and any of the other investment funds sponsored or accounts managed by the Adviser or its affiliates may not always, and often will not, be proportional. In general, pursuant to the Blue Owl Credit Advisers’ investment allocation policy, the process for making an allocation determination includes an assessment as to whether a particular investment opportunity (including any follow-on investment in, or disposition from, an existing portfolio company held by the Company or another investment fund or account) is suitable for us or another investment fund or account including the Blue Owl Credit Clients. In making this assessment, the Blue Owl Credit Advisers may consider a variety of factors, including, without limitation: the investment objectives, guidelines and strategies applicable to the investment fund or account; the nature of the investment, including its risk-return profile and expected holding period; portfolio diversification and concentration concerns; the liquidity needs of the investment fund or account; the ability of the investment fund or account to accommodate structural, timing and other aspects of the investment process; the life cycle of the investment fund or account; legal, tax and regulatory requirements and restrictions, including, as applicable, compliance with the 1940 Act (including requirements and restrictions pertaining to co-investment opportunities discussed below); compliance with existing agreements of the investment fund or account; the available capital of the investment fund or account; diversification requirements for BDCs or RICs; the gross asset value and net asset value of the investment fund or account; the current and targeted leverage levels for the investment fund or account; and portfolio construction considerations. The relevance of each of these criteria will vary from investment opportunity to investment opportunity. In circumstances where the investment objectives of multiple investment

funds or accounts regularly overlap, while the specific facts and circumstances of each allocation decision will be determinative, the Blue Owl Credit Advisers may afford prior decisions precedential value.

Pursuant to the Blue Owl Credit Advisers’ investment allocation policy, if through the foregoing analysis, it is determined that an investment opportunity is appropriate for multiple investment funds or accounts, the Blue Owl Credit Advisers generally will determine the appropriate size of the opportunity for each such investment fund or account. If an investment opportunity falls within the mandate of two or more investment funds or accounts, and there are no restrictions on such funds or accounts investing with each other, then each investment fund or account will receive the amount of the investment that it is seeking, as determined based on the criteria set forth above. Certain allocations may be more advantageous to us relative to one or all of the other investment funds, or vice versa. While the Blue Owl Credit Advisers will seek to allocate investment opportunities in a way that it believes in good faith is fair and equitable over time, there can be no assurance that our actual allocation of an investment opportunity, if any, or terms on which the allocation is made, will be as favorable as they would be if the conflicts of interest to which the Adviser may be subject did not exist.

Exemptive Relief

We, the Adviser and certain of its affiliates have been granted an order for exemptive relief, as amended (the “Order”) by the SEC to co-invest with other funds managed by the Adviser or its affiliates in a manner consistent with our investment objective, positions, policies, strategies and restrictions as well as regulatory requirements and other pertinent factors. Pursuant to such exemptive relief, we generally are permitted to co-invest with certain of our affiliates if a “required majority” (as defined in Section 57(o) of the 1940 Act) of our independent directors make certain conclusions in connection with a co-investment transaction, including that (1) the terms of the transaction, including the consideration to be paid, are reasonable and fair to us and our shareholders and do not involve overreaching by us or our shareholders on the part of any person concerned, (2) the transaction is consistent with the interests of our shareholders and is consistent with our investment objective and strategies, (3) the investment by our affiliates would not disadvantage us, and our participation would not be on a basis different from or less advantageous than that on which our affiliates are investing and (4) the proposed investment by us would not benefit our Adviser or its affiliates or any affiliated person of any of them (other than the parties to the transaction), except to the extent permitted by the exemptive relief and applicable law, including the limitations set forth in Section 57(k) of the 1940 Act. See “Business — Affiliated Transactions” in our 2023 Form 10-K. The Blue Owl Credit Advisers’ allocation policy incorporates the conditions of the Order. As a result of the Order, there could be significant overlap in our investment portfolio and the investment portfolio of the Blue Owl Credit Clients that could avail themselves of the exemptive relief and that have an investment objective similar to ours. See “Business—The Adviser and Administrator—Blue Owl Credit Advisors LLC” in our 2023 Form 10-K. In addition, the Order to permits us to participate in follow-on investments in our existing portfolio companies with certain affiliates that are private funds if such private funds did not have an investment in such existing portfolio company. Merger Agreement

On August 7, 2024, we entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Blue Owl Capital Corporation III, a Maryland corporation (“OBDE”), Cardinal Merger Sub, Inc., a Maryland corporation and our wholly owned subsidiary (“Merger Sub”), and, solely for the limited purposes set forth therein, the Adviser and Blue Owl Diversified Credit Advisers LLC, a Delaware limited liability company and investment advisor to OBDE (“ODCA”). The Merger Agreement provides that, subject to the conditions set forth in the Merger Agreement, Merger Sub will be merged with and into OBDE, with OBDE continuing as the surviving company and as our wholly-owned subsidiary (the “Initial Merger”), and, immediately thereafter, OBDE will merge with and into us, with us continuing as the surviving company (the “Second Merger” and together, with the Initial Merger, the “Mergers”). The parties to the Merger Agreement intend the Mergers to be treated as a “reorganization” within the meaning of Section 368(a) of the Code.

Effective upon the closing of the Mergers, each share of OBDE common stock issued and outstanding immediately prior to the effective time of the Mergers, except for shares, if any, owned by us or any of our

consolidated subsidiaries, will be converted into the right to receive a number of shares of our common stock equal to the Exchange Ratio (as defined below), plus any cash (without interest) in lieu of fractional shares, in connection with the closing of the Mergers.

Under the terms of the Merger Agreement, the “Exchange Ratio” will be determined as of a mutually agreed date (such date, the “Determination Date”) no earlier than 48 hours (excluding Sundays and holidays) prior to the effective date of the Mergers and based on (i) the net asset value (“NAV”) per share of our common stock (the “OBDC Per Share NAV”) and the adjusted net asset value per share of OBDE (the “OBDE Per Share NAV”) and (ii) the closing price per share of our common stock on the NYSE on either the Determination Date or, if the NYSE is closed on the Determination Date, the most recent trading day prior to the Determination Date (the “OBDC Common Stock Price”).

The Exchange Ratio will be calculated as follows:

•if the quotient of the OBDC Common Stock Price and the OBDC Per Share NAV is less than or equal to 100%, then the Exchange Ratio shall be the quotient (rounded to the fourth nearest decimal) of the OBDE Per Share NAV and the OBDC Per Share NAV;

•if the quotient of the OBDC Common Stock Price and the OBDC Per Share NAV is greater than 100% but less than or equal to 104.5%, then the Exchange Ratio shall be equal to the quotient (rounded to the fourth nearest decimal) of (A) the product of (x) the OBDE Per Share NAV and (y) the sum of (i) 1.00 and (ii) 50% of the difference between (a) the quotient of (I) the OBDC Common Stock Price and (II) the OBDC Per Share NAV and (b) 1.00 and (B) the OBDC Common Stock Price; or

•if the quotient of the OBDC Common Stock Price and the OBDC Per Share NAV is greater than 104.5%, then the Exchange Ratio shall be equal to the quotient (rounded to the fourth nearest decimal) of (A) the product of (x) the OBDE Per Share NAV and (y) 102.25% and (B) the OBDC Common Stock Price.

Consummation of the Mergers, which is currently anticipated to occur during the first quarter of 2025, is subject to certain closing conditions, including (1) requisite approvals of OBDE’s and our shareholders, (2) the absence of certain enumerated legal impediments to the consummation of the Mergers, (3) effectiveness of the registration statement for our common stock to be issued as consideration in the Mergers, (4) subject to certain exceptions, the accuracy of the representations and warranties and compliance with the covenants of each party to the Merger Agreement, (5) required regulatory approvals (including expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended), (6) the absence of a material adverse effect in respect of the parties, and (7) the receipt of customary legal opinions to the effect that the Mergers will be treated as a “reorganization” within the meaning of Section 368(a) of the Code by the parties.

Prior to the anticipated closing of the Mergers, we and OBDE intend to declare and pay ordinary course quarterly dividends.

Prior to the anticipated closing of the Mergers, subject to the approval of OBDE's board of directors, OBDE will declare a dividend to its shareholders equal to any undistributed net investment income estimated to be remaining as of the closing of the Mergers. This will include any unpaid special dividends previously declared in conjunction with OBDE's listing in January 2024.

In connection with the Mergers, we and OBDE filed with the SEC and mailed to our respective shareholders a joint proxy statement/prospectus (the “Joint Proxy Statement”) and we filed with the SEC a registration statement on Form N-14 that included the Joint Proxy Statement and our prospectus. The definitive joint proxy statement and prospectus was filed with the SEC on October 21, 2024. See “Risk Factors” in our Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2024 (“Second Quarter 2024 Form 10-Q”) for risks relating to the Mergers. Based on financial data as of September 30, 2024 and before giving effect to this offering, we would have had $18.56 billion in combined total assets and total funded debt of $10.3 billion if the Mergers had been completed on September 30, 2024 and our total funded debt would have been comprised of approximately 50% unsecured notes, 12% revolving credit facilities, 14% special purpose vehicle asset credit facilities, and 24% debt securitizations. As

of September 30, 2024, our portfolio investments overlapped with portfolio investments of OBDE represented 76% of our total investment portfolio at fair value. OBDE’s portfolio investments that overlapped with our portfolio investments represented 96% of OBDE investment portfolio at fair value as of September 30, 2024.

The diversity by obligor of our total investment portfolio at fair value as of September 30, 2024 compared to OBDE, and on a pro forma basis to reflect the Mergers, is set forth below:

| | | | | | | | | | | | | | | | | |

| | | | | Pro Forma |

| OBDC | | OBDE | | OBDC |

Top 10 Investments | 25 | % | | 21 | % | | 22 | % |

Top 25 Investments | 44 | % | | 42 | % | | 40 | % |

Remaining Investments | 56 | % | | 58 | % | | 60 | % |

Our key portfolio metrics (percentage of total investment portfolio at fair value as of September 30, 2024) compared to the portfolio metrics of OBDE, and as shown on a pro forma basis to reflect the proposed Mergers, are set forth below.

| | | | | | | | | | | | | | | | | |

| | | | | Pro Forma |

| OBDC | | OBDE | | OBDC |

Asset Mix |

| |

| | |

First-lien | 76 | % | | 85 | % | | 78 | % |

Second-lien | 5 | % | | 5 | % | | 5 | % |

Unsecured | 2 | % | | 2 | % | | 2 | % |

Preferred Equity | 3 | % | | 3 | % | | 3 | % |

Common Equity | 11 | % | | 5 | % | | 9 | % |

Joint Ventures | 3 | % | | <1 % | | 2 | % |

| | | | | |

Internal Performance Ratings | | | | | |

Internal Performance Rating 1 | 6 | % | | 10 | % | | 7 | % |

Internal Performance Rating 2 | 87 | % | | 85 | % | | 86 | % |

Internal Performance Rating 3 | 6 | % | | 5 | % | | 6 | % |

Internal Performance Rating 4 | 1 | % | | <1 % | | 1 | % |

Internal Performance Rating 5 | <1 % | | <1 % | | <1 % |

Non-Accrual Investments | | | | | |

Non-Accrual Investments(1) | 0.7 | % | | 0.2 | % | | 0.5 | % |

Industry(2) | | | | | |

Internet Software and Services | 11 | % | | 13 | % | | 12 | % |

Insurance | 8 | % | | 11 | % | | 9 | % |

Food and Beverage | 7 | % | | 5 | % | | 7 | % |

Healthcare providers and services | 6 | % | | 8 | % | | 7 | % |

Healthcare technology | 6 | % | | 7 | % | | 6 | % |

Asset Based Lending and Finance | 6 | % | | 1 | % | | 5 | % |

Manufacturing | 5 | % | | 3 | % | | 5 | % |

Business Services | 4 | % | | 7 | % | | 5 | % |

Buildings and Real Estate | 4 | % | | 3 | % | | 4 | % |

Consumer Products | 4 | % | | 3 | % | | 3 | % |